7 Best Tips on How to Prepare for Hyperinflation

Podcast: Play in new window | Download

There are many reasons you might want to know how to prepare for hyperinflation.

Maybe you have a lot of debt to pay off. Perhaps you're worried that the value of money will go down so much that it will be hard to afford basic needs like food and water.

No matter your reasons, it's always a good idea to be prepared for the worst-case scenario.

Challenges of Preparing for Hyperinflation

The immediate challenge most people face when preparing for hyperinflation is knowing what is and how to prepare for it.

Another challenge is that some people don't want to admit that there's a problem. They might think that hyperinflation won't happen or that they don't need to worry about it. And if you're not prepared correctly, you might end up losing money instead of saving it.

When it comes to hyperinflation, I know how you feel. You're struggling to make ends meet, and it seems like every day, the cost of living goes up a little more. You're not sure how you'll pay your bills this month, let alone next month. The financial futures of your family members are at risk. What do you do?

I feel your pain. I've been there before too. And I know that there's no easy answer to your problems. But I also know that you can do things to make things a little bit easier for yourself.

That's what I want to talk to you about today – how to prepare for hyperinflation in case it happens.

Inflation vs. Hyperinflation

First, to understand hyperinflation, it's essential to first understand inflation.

Inflation is defined by Dictionary.com as:

“a persistent, substantial rise in the general level of prices related to an increase in the volume of money and resulting in the loss of value of currency.”

In short, inflation is the decline of a currency's purchasing power over time. Therefore, as inflation increases, the value of your money decreases, which diminishes your purchasing power.

When it comes to measuring inflation, inflation is measured using the consumer price index, which is “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.” (Source)

The bottom line on inflation is, because of inflation, the money you have today, will be worth less tomorrow.

What Is Hyperinflation?

Hyperinflation is an extreme type of inflation. The economy becomes very unstable during hyperinflation, and it destroys the value of paper money resulting in a financial crisis.

Investopedia.com defines hyperinflation as:

“…a term to describe rapid, excessive, and out-of-control general price increases in an economy. While inflation is a measure of the pace of rising prices for goods and services, hyperinflation is rapidly rising inflation, typically measuring more than 50% per month.”

In other words, hyperinflation (the devaluation of money) can lead to the costs of goods and services doubling, tripling, and more in a very short period of time.

What Causes Hyperinflation?

Many different factors can cause hyperinflation.

According to CorproateFinanceInstitute.com:

“Hyperinflation commonly occurs when there is a significant rise in money supply that is not supported by economic growth. The increase in money supply is often caused by a government printing (money) and injecting more money into the domestic economy or to cover budget deficits. When more money is put into circulation, the real value of the currency decreases, and prices rise.”

When a country experiences hyperinflation, it can be difficult for the average person to get by. This is because the value of money decreases rapidly, and it becomes difficult to purchase basic necessities.

The Current State of Inflation and Hyperinflation

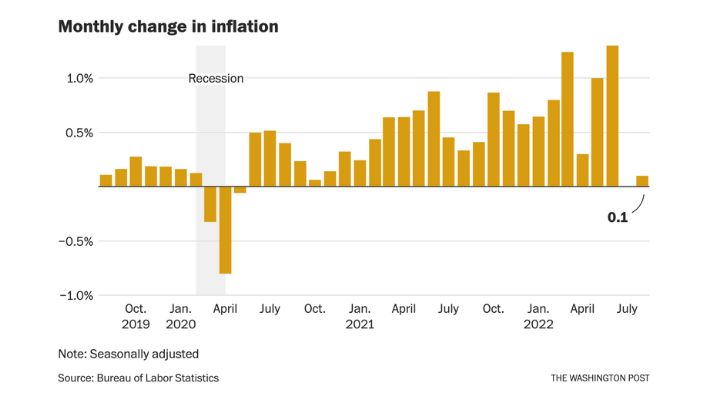

Unfortunately, we continue to experience a 40-year high in inflation, with no sign of relief on the horizon.

According to Washington Post:

“A number of economists had been hopeful that the precipitous, two-month decline in gas prices would finally help cool inflation, but the data released Tuesday showed how large price increases persist for core items that make up a central part of most families’ budgets. Housing and food remained major strains.

The government’s food index, for example, has risen 11.4 percent over the past year, the largest 12-month increase since May 1979. Food prices were up 0.8 percent from July to August. Flour was up 2.2 percent over that span. Potato prices rose 2.5 percent. Butter jumped 1.9 percent, and canned fruit spiked 3.4 percent.

The figures came from the Bureau of Labor Statistics, which released its monthly consumer price index. It showed that, overall, costs were up 8.3 percent in August compared with 12 months earlier, higher than analysts expected. The overall figure was lower than the inflation rate notched in July and June, but many economists were expecting to see a steeper decline.”

Disclaimer: It's 2022, and I need to remind people that I'm a blog writer with an MBA and a Mind4Survival. I am NOT a financial advisor, nor am I offering anything other than what I feel is my thoughtful perspective on how to prepare for hyperinflation. In the end, we are our own best advocates, therefore, do your due diligence when it comes to all financial matters and act in the best interest of you and your family.

With that, here are my seven best tips on how to prepare for hyperinflation!

What are the 7 Best Tips on How to Prepare for Hyperinflation?

1. Prepare for Hyperinflation by Stocking up on Necessities

It's always a good idea to be prepared for the worst-case scenario. And that's especially true when it comes to hyperinflation. Hyperinflation is a situation in which the value of money decreases so much that it's hard to afford basic needs like food, clothing, and toiletries.

If you're not prepared for hyperinflation, you might end up losing money instead of saving it. That's why it's essential to stock up on your basic necessities, such as household supplies.

You might also want to invest in gasoline, coal, and steel commodities. These commodities will become more valuable in a hyperinflationary economy, so it's a good idea to invest in them now. For example, as gas prices rise, the fuel you invest in today will be worth more tomorrow.

Basic Needs to Stockpile

Dry Goods – Store as much dry food as possible, such as rice, beans, spices, etc.

Canned Foods – buy a lot of canned vegetables and meats for long-term storage. You can also use them for trading with other people if hyperinflation worsens.

Family Clothing – one of the most essential things to stockpile is clothing. You'll want to have enough clothes to last for at least a year. Make sure to include durable clothing that meets the seasonal needs of your area.

Personal Hygiene Products – you'll want to have enough personal hygiene products to last for at least a year. This includes things like soap, shampoo, toothpaste, and toilet paper.

Prescription and OTC Medications

In addition to basic necessities, you'll also want to stockpile prescription and over-the-counter (OTC) medications. You'll want to have enough medication to last for at least a year. When stocking up on medications, be sure to keep an eye on their expiration dates. Here's an article that explores the subject in depth.

Some medications that you might want to stock up on include:

- Antibiotics

- Painkillers

- Diarrhea Medication

- Allergy Medication

- Asthma Inhalers

2. Keep Your Money in a Safe Place

In a time of hyperinflation, it's important to keep your money in a safe place. That's because the value of money can change drastically from day to day. You don't want to risk losing all your money because it became worthless overnight.

How to Keep Your Money Safe During Hyperinflation

Gold and Silver Coins – During hyperinflation, gold and silver coins will be valuable because they're a stable currency. You might want to invest in them now so you can use them later if paper currency and the stock market fail. Don't forget to examine other precious metals that may work for your situation when doing your research.

Barter Items – In addition to rare metals, you can also use goods and services to trade for other goods and services. This is known as bartering. If you have items that other people need, you can use them to get something you want or need. For example, as gasoline prices rise, your prior investment will become an excellent barter item.

Some items that are good for bartering include:

- Canned Foods

- Clothing

- Medications

- Fuel

- Alcohol and other luxury items

What to Do With Your Money to Protect Against Hyperinflation

During hyperinflation, the value of money will drop quickly. Therefore, it's essential to do everything you can to protect your money. Some strategies that you might want to use include:

Increase Your Income – One way to defend against hyperinflation is by increasing your income through investments or starting a business. For example, if you have a job that offers raises every year, make sure you negotiate for the most significant raise possible. You can also start a side hustle to bring in extra money. Another option is investing in assets that will offer a steady income stream.

Decrease Your Debt – Another way to protect your money during hyperinflation is to decrease your debt. This will reduce the amount of money you owe while increasing the amount of money to buy your necessities.

There are a few things you can do to decrease your debt, including:

- Negotiate a lower interest rate on your credit cards

- Pay off high-interest debt first

- Consolidate your debt into a single loan with a lower interest rate

- Take out a personal loan to pay off your high-interest credit cards.

3. Buy and Store Non-perishable Food Items Like Canned Goods and Dry Goods

During hyperinflation, it's important to have food stored up in case the economy collapses. That's because you and your family will still need to eat as food prices skyrocket. In addition, food will become more valuable as the economy deteriorates.

Tips for Buying and Storing Non-perishable Food Items During Hyperinflation

Buy What You Eat – Get non-perishable food that your family will eat. You don't want to end up with cans of beans you never touch because it defeats the whole purpose of stocking up on food.

Storage Space – Consider how much space you have available for storage items, how long the items will last, how many people are in your household, and what your family likes to eat. Then, create a stockpile of food that will last for at least six months. Make sure to get a variety of food items that will appeal to everyone in your household.

Rotate Your Food – It's important to rotate your food stock so that your food items do not expire before you get the chance to eat them. This means that you should eat the oldest food first and replace it with a new food item. This will help you ensure that you always have food available in case of an emergency.

Food Items to Buy and Store

Canned Foods – Canned foods will be one of your best options during hyperinflation because they have a long shelf life. Plus, canned veggies and fruits are good for you, and most people like them. Consider buying canned vegetables, fruit, beans, meat spreads, soups, etc.

Dry Goods – You can also buy dry goods. These include pasta, rice, dried fruits and vegetables, flour, oatmeal, etc.

Long-term Storage Food – Another thing you might want to consider for your long-term storage is food items that have a long shelf life. This will provide an excellent, shelf-stable addition to your food resources. Dehydrated and freeze-dried foods are a great way to supplement the fresh food options you can get during an economic crisis.

How to Store Food to Maximize Shelf Life and Quality

Containers – Using the correct type of container for your canned and dry goods can help extend how long they last. For example, you should avoid using containers that use porous plastic or metal because they will allow moisture to get into the food items. This will decrease how long your food lasts and lead to spoilage. Instead, it's essential to store your food in airtight and moisture-free containers. This will help to keep your food fresh and prevent it from spoiling.

Sunlight – One other thing you can do to help maximize the shelf life of your food is to store it out of direct sunlight. Sunlight can cause food to spoil faster, so it's important to keep your food in a cool, dark place. This will help to keep your food fresh for as long as possible.

Temperature – Temperature control is important when storing food, as it can help prevent spoilage. In general, you want to keep your foods stored in a cool area, avoiding extreme temperatures. This will help to keep your food fresh and prevent it from spoiling.

4. Invest in Commodities Such as Fuel, Precious Metals, Lumber, and Cryptocurrency

When preparing for hyperinflation, it's also essential to carefully invest in commodities. This will help you protect your money and ensure that you have something of value during an economic crisis. Some options to invest in include fuel, precious metals, lumber, and cryptocurrency.

Fuel – Fuel is one of the best commodities to invest in during hyperinflation. This is because there is always a demand for fuel, and it's something that people need to live their lives. In addition, the price of fuel is likely to go up during a time of hyperinflation, so it's a good investment option.

Precious Metals – Precious metals are a great investment option during a time of hyperinflation. This is because they hold their value well, and they are something that people will always need. In addition, the price of precious metals is likely to go up during a time of hyperinflation, so it's a wise investment option. Some suitable metals to invest in include gold, silver, and platinum.

Lumber – Another good commodity to invest in during hyperinflation is lumber. There is always a demand for lumber, and the price is likely to go up during a crisis. In addition, lumber is something that people will need to rebuild their lives after an economic disaster.

Cryptocurrency – When preparing for hyperinflation, it's crucial to invest in commodities that hold their value. One option is cryptocurrency. While it is at a current low, the value of Bitcoin and other cryptocurrencies has skyrocketed in recent years. Therefore they could be an excellent investment during a time of hyperinflation.

If you're new to cryptocurrency, it's essential to do your research before investing. Learn about the different types of cryptocurrencies available, how to buy them, and how to store them. Also, be sure to keep track of the market value of other cryptocurrencies so you can make the wisest investment possible.

With cryptocurrency, you're taking a risk, but if it's timed correctly, it could pay off big time. So if you're looking for a way to protect your money during a time of hyperinflation, investing in cryptocurrency may be a good option. However, it's essential to do your research before investing, as there are many different types of cryptocurrencies available, and their values can fluctuate rapidly.

Warning About Commodities!

Hyperinflation does not happen during stable and certain economic times. Hyperinflation happens when the economy is unstable and uncertain. Therefore, be careful about any investments you make. It's during these times that fortunes are mostly lost and mostly lost due to sure things that can't miss.

As commodities rise and fall, so too can your investment. Nothing shows that more than the recent crypto crash. Will crypto recover? Possibly and if it does, the people who are investing in it now, just like anyone who buys low, may experience a magnificent windfall. That is, if and when it recovers. Otherwise, they may, as with any investment, experience a dramatic loss.

5. Get Out of Debt as Soon as Possible

Debt can be a significant burden, especially during an economic crisis. When you're struggling to make ends meet, it's important to pay debts off as soon as possible. This will help lighten the load and make getting by during a crisis easier.

There are several things you can do to get out of debt:

Make a Budget – Making a budget and sticking to it is one of the best ways to get out of debt. Knowing how much money you have to work with makes it easier to stay within budget.

Stop Using Credit Cards – Unsecured credit card debt can make it even more challenging to get out of debt. If you're struggling with having a debt-free lifestyle, stop using your credit cards and only use cash until you're back on your feet. Stop paying high-interest rates! Instead, keep your purchasing power for you and your family.

Cut Out Non-Essential Purchases – Another good way to get out of debt is to cut all non-essential purchases. This may include eating out, going to the movies, and buying unnecessary items. When you're trying to get out of debt, it's important to be frugal and only spend money on necessary things.

Sell Unnecessary Belongings – When you're in debt, it's a good idea to sell any unnecessary belongings. This can include things like second vehicles, TVs, and electronics that you don't use. By selling these items, you'll be able to generate some extra cash to put towards your debt.

When downsizing your unnecessary belongings, in addition to online opportunities, consider resale shops, and garage sales, as possible ways to get rid of what you don't need.

Take on an Extra Job – If possible, taking on an extra job can be a great way to get out of debt. When you have more money coming in each month, it's easier to pay off your debts. There are several different types of jobs you can take on, so it's crucial to find one that fits your skills and interests.

If you're looking for a job, consider looking into online opportunities. Several different websites allow you to work from home, which can be a great option if you're struggling to find a job in your area.

Negotiate With Your Creditors – If you're having trouble paying off your debts, one thing you can do is negotiate with your creditors. When you call and talk to them about how much money you can afford to pay, they may be willing to work with you.

However, not all creditors will work this way, so it's essential to research before calling. Several websites offer information on negotiating with creditors, and it's a good idea to have a plan before you call.

It's important to know that any credit card debt negotiated away will be considered income for you on your taxes.

6. Stay Informed About Hyperinflation

It's also essential to stay informed about the latest news and events affecting hyperinflation. This will help you make the most intelligent decisions possible regarding your finances.

Subscribe to a Financial Newsletter – One great way to stay informed is by subscribing to a financial newsletter. This will give you regular updates on the latest news and events affecting the economy. You can also stay informed by following financial bloggers and reading financial articles online.

Follow Financial YouTube Channels – Another great way to stay informed about the latest news and events affecting the economy is by following financial channels. This will give you regular updates on the latest news and events affecting the economy.

Some tremendous financial channels to follow include:

Stay Informed On Social Media – If you're looking for a quick and easy way to stay informed about the economy, consider following politicians and news organizations on social media. You can get regular updates from these accounts that will allow you to stay informed on the latest events.

7. Be Personally Responsible

Another vital tip for preparing for hyperinflation is to be personally responsible for your money. This means keeping track of how much you make, how much debt you have, how much money you're spending each month, and how much money you're saving.

Another vital tip for preparing for hyperinflation is to be personally responsible for your money. This means keeping track of how much you make, how much debt you have, how much money you're spending each month, and how much money you're saving.

Being careful with how you spend your money will make it easier to get and stay out of debt and prepare for hyper inflation.

The Bottom Line on How to Prepare for Hyperinflation

The fact is hyperinflation is beyond your control. What is in your control is how you prepare for hyperinflation.

When it comes to preparing for hyperinflation, there are several things you can do to prepare for hyperinflation. This includes stocking up on necessities, keeping your money in a safe place, and carefully investing in researched commodities.

Lastly, make sure you get out of debt as soon as possible and stay informed about hyperinflation.

Do you have any tips for preparing for hyperinflation? Let us know in the comments below.

Additional Resources:

- How to Survive Inflation: Spend or Save?

- How to Prep on a Shoestring Budget

- Five Ways to Make Quick Money

- How to Start Prepping on a Budget With the Basics

Stay safe,

Related Articles

FREE Guide

Read the Best Seller

Join Mind4Survival

Stay informed by joining the Mind4Survival! 100% Secure! 0% Spam!

Affiliate Disclosure...

Mind4Survival is a free, reader supported information resource. If you make a purchase through our link, we may, at no cost to your, receive an affiliate commission.

Do You Want To Be Ready No Matter What?

Download our free 39-page guide with interactive, 7-Day Emergency Kit Checklist and take the first step toward real preparedness.

- Know exactly where to start.

- Save time and money.

- How-to build a complete Basic Emergency Kit.

- Level up your safety and security.

Join Mind4Survival

Stay informed by joining the Mind4Survival! 100% Secure! 0% Spam!

“Lastly, make sure you get out of debt as soon as possible”

This should be first.

Before Anything Elese.

I can certainly get on board with that! Thanks for taking the time to leave some feedback and advice to help others. Much appreciated. ~Brian

while I don’t have any debt, getting rid of debt during hyper inflation is ridiculous! You are paying back debt cents on the dollar!!! dollar might be worthless but the monthly payment stays the same.

Crypto??? LOL Crypto is still a fiat currency, backed by nothing!!! Stick to gold for when and if there is a comeback and silver for trading.

Another thing to consider is how to defend what you have acquired to keep ahead. Why do you think the government is trying hard to take that away from us…

Yes, dollars might be worthless and the monthly payments will be the same. At the same time, people will be spending more on food and still be paying on their debt. Do you have any recipes for frying up credit cards once a person doesn’t have enough money to purchase food? Either way, thanks for taking the time to leave a comment. Whoever is right, I think we can agree the situation our Govt has us in stinks! Sta safe! ~Brian

Thank you, Brian Duff!

Back at you! ~Brian

The value of Bitcoin has dropped by two-thirds in the past seven months, from $65,468/Btc to $21,001 today (June 16th).

$21,000 is no big deal if you bought in ten years ago at $6.50, but most didn’t. Now ain’t the time to mess with crypto.

Aside from that, good article.

Thanks so much for your feedback! I will start by saying that you may very well be correct and Crypto is tanking. That is a total and undeniable possibility. And another possibility is Crypto, like the majority of anything that is worth something, is cratering right now. And, as with people who buy real estate, stocks, and precious metals, most will tell you to buy low and sell high. Therefore, a crypto person may counter by saying Crypto is still valuable. They may believe that it is going through a downturn with the majority of the economy, and if you hold on to it, it will be worth millions later. I imagine some may say now is a great time to buy! In the end, I believe all assets are on the table for devaluation, and ultimately, we won’t know which assets do the best or do the worst for at least 6-months, and maybe significantly more. I feel like everything is a risk right now. Thanks again for your insight! ~Brian

If you are buying crypto currencies for anything more than Insurance against future uncertainties then you should not be buying crypto.

When has the U.S. experienced hyper inflation? I’m old enough to remember the inflation mess we had during the 1970’s.

we survived it people need to start thinking before the buy stuff. If you want to buy a $50,000 car; why not put down a $25,000 down payment?